- Attention Customers: E-Invoicing has been Mandatory for GST Taxpayers having Turnover ₹ 5 Cr & above w.e.f 1st August 2023.

- Attention Customers: E-Invoicing has been Mandatory for GST Taxpayers having Turnover ₹ 5 Cr & above w.e.f 1st August 2023.

About us

Aligned with our vision of providing technology-enabled business solutions, we strive to deliver end-to-end solutions for our clients’ most pressing business needs. Alankit an GSP providing all GST Solutions and in 2017 became the first GST Suvidha Provider (GSP) in India.

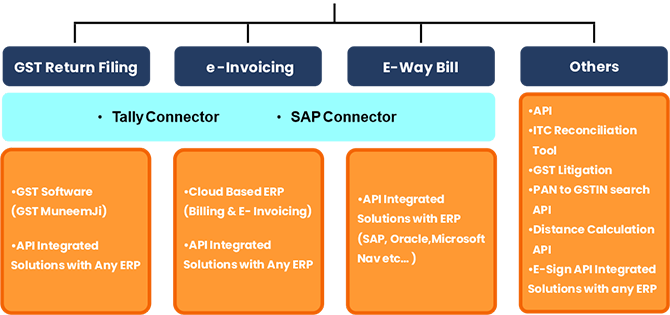

GST Products & Services

Alankit GST SAP Solution

This is an exclusively designed SAP ABAP Add on that makes the GST Compliance hassle free for industries.

GST Suvidha Provider

Every taxpayer in the country is required to abide by compliances under the GST regime to pay taxes and file returns at regular intervals. To comply with the provisions of GST law, the taxpayer is required to file return forms, apply for GST Registration application, generate challans, upload invoices, etc on the GST portal. To meet the GST compliance, it becomes quite challenging for a majority of taxpayers who have to upload invoices every month. Hence, such taxpayers require automation to ensure seamless return filing. This is where GST Suvidha Provider comes in picture and plays a crucial role to make GST compliance simple and convenient for the taxpayers.

GST Suvidha Provider (GSP) – An overview

GSP refers to GST Suvidha Provider, defined as an exclusive entity authorized to enable a platform for businesses, accounting professionals, and taxpayers to access GST portal services. It helps taxpayers to comply with the GST laws through GST Software applications and APIs. One of the top GST Suvidha Providers (GSPs), Alankit displays superior standards in offering services to the taxpayers for complying with all regulatory requirements under Goods and Service Tax (GST). To ensure ease of doing business and transparency, the Company brings the desired support through mobile or web-based interfaces and serves as a one-stop-shop for all GST compliance-related services. As a premier integrated service provider, Alankit has launched its three GST solutions to get business entities on board with GST for increased compliance:

GST Muneemji Software:

Introduced to ensure a smooth implementation process, GST Muneemji is secure and integrated cloud-based compliance software that performs a majority of functions like return filing, invoice management, reconciliation, dashboard & reporting, etc.

E-Raahi:

An advanced technology solution, e-Raahi is cost-effective GST Accounting Software designed for creating e-way bills and tax invoices. It simplifies the business process by enabling operations such as GST Filing, accurate calculation of taxes, easy scanning of QR code from the mobile, etc.

Saarthi:

Saarthi, a tablet-based Point of Sale (PoS) device is used by small scale businesses for GST compliance as GST compliant billings and return filings.

Services Offered under GST Regime

For ASPs

- Pass Through API

- Multiple Interfacing options

- GSTN Failure Handling

- High Availability and Error Tolerance

- Data Privacy & Security

- Seamless Data Relay

For Taxpayers

- Cloud Based ERP( Billing & E-Invoicing)

- API Integrated Solutions with ERP.

- Facilitates automated upload & download of Invoices data

- Enables automated reconciliation of inward/outward Supplies

- Helps in applying for registration

- Facilitates automated return filing

Advantages of meeting GST compliance through ASP-GSP

- Consumption across various technologies and digital platforms (mobile, desktops, tablets, etc.) based on client requirements

- Facilitates automated data uploading & downloading

- Ability to adapt to changing taxation and regulatory

- Ensures high levels of security and data protection

- Allows an end-to-end integration with customer software (ERP system or Accounting system) to ensure data is fetched automatically

Why Choose Alankit?

- Established and trusted brand name in the industry having operations through a wide network of 26 Regional Offices, spread out at 10000+ Business Locations in 673+ Cities.

- Professional Team of GST Experts provides consultancy services and solutions to all GST related queries, be it related to software, computation or just about anything.

- Facilitates the compliance services for its clients and easily connects to the GSTN, being an authorized GSP.

- Exclusive billing machine software to help customers with printing bills or receipts as required, unlike any other GST Suvidha Provider.

- Enables simplified and convenient procedures for the clients, opening channels to advanced features and innovative technology at every step.

- Ensures efficiency and transparency by providing all GST solutions under one roof.

- Robust IT setup and unmatched infrastructure enabling us to compete in an equipped manner

- If there any further requirement, please let us know.

0

Micro & Small

Business Enterprises